The Bank of England has chosen a new person to grace one of its pound sterling notes, the BBC reports. Alan Turing, the computer scientist who lent his code-breaking expertise to the Allied powers in World War II, will soon be the new face of the £50 banknote.

Alan Turing's life story has been the subject of a play, an opera, and the 2014 Oscar-winning film The Imitation Game, starring Benedict Cumberbatch. Turing's biggest claim to fame was cracking the Enigma code used by the Nazis to send secret messages. By decrypting the system and interpreting Nazi plans, Turing helped cut World War II short by up to two years, according to one estimate.

Despite his enormous contributions to the war and the field of computer science, Turing received little recognition during his lifetime because his work was classified, and because he was gay: Homosexual activity was illegal in the UK and decriminalized in 1967. He was arrested in 1952 after authorities learned he was in a relationship with another man, and he opted for chemical castration over serving jail time. He died of cyanide poisoning from an apparent suicide in 1954.

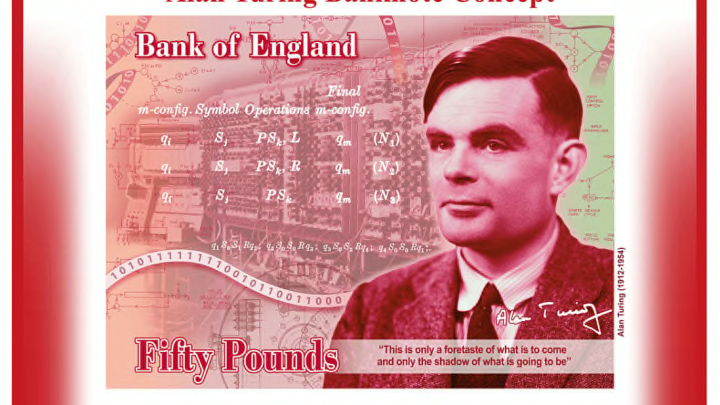

Now, decades after punishing him for his sexuality, England is celebrating Turing and his accomplishments by giving him a prominent place on its currency. The £50 note is the least commonly used bill in the country, and it will be the last to transition from paper to polymer. When the new banknote enters circulation by the end of 2021, it will feature a 1951 photograph of Alan Turing along with his quote, "This is only a foretaste of what is to come and only the shadow of what is going to be."

Turing beat out a handful of other British scientists for his spot on the £50 note. Other influential figures in the running included Rosalind Franklin, Ada Lovelace and Charles Babbage, Stephen Hawking, and William Herschel.

[h/t BBC]