We use our smartphones to hail a car service, order groceries, navigate a new route, and stay in touch with friends. But budgeting? Not so much. According to a Bankrate poll, just 8 percent of Americans use a smartphone to track their spending. In our modern era, the most popular record-keeping method is decidedly old school: Pen-and-paper accounted for 36 percent of budgets. Another 18 percent use a computer program and 18 percent keep track in their heads (yikes).

But the appeal of mobile is clear: Checking your budget takes just a tap of the app, so you can verify in the check-out line whether you’re on point with your spending (and second guess purchases before you swipe your card). If you’re ready to see if mobile makes budgeting better, here are five apps worth considering:

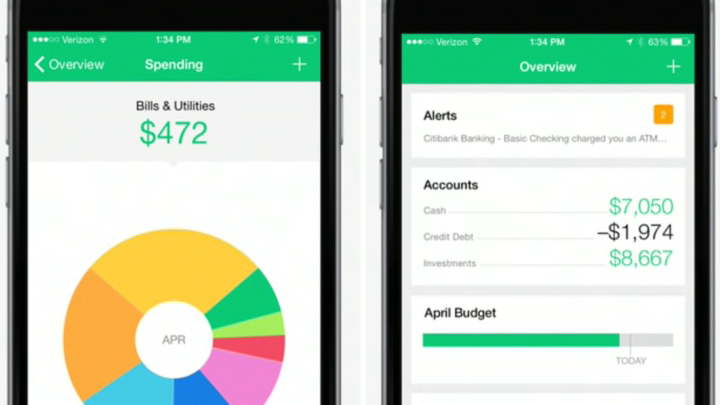

1. MINT, FREE

Great if:

You want to keep an eye on your complete financial picture

How it works: Even if you’ve never tracked a dollar in your life, you’ve probably heard of Mint. The popular site and app syncs with your financial accounts to automatically track where you’re spending your money. It also categorizes recurring expenses automatically (like moving every Starbucks charge to “dining”) so you can take a totally hands-off approach to budgeting.

Dollar details: Mint has earned especially ardent fans among those who want to keep an eye on their spending in the larger context of their finances. You can set and track savings goals, see your credit score, and monitor investments. Because you don’t have to manually enter or verify expenses, some complain that it’s too easy to ignore the app. If that might be true for you, turn on the alerts feature to receive automatic text messages when you exceed your budget or get hit with a bank fee.

2. GOODBUDGET, $5/MONTH OR $45/YEAR

Great if:

You want the accountability of manually tracking your expenses

How it works: Create digital “envelopes” (groceries, gas, etc.) and then assign a dollar amount to each. This app doesn’t sync with any of your bank accounts, so you’ll have to enter each transaction. Some consider that a downside, but fans argue that manual tracking makes you more mindful of your spending and makes it easy to track both cash and plastic purchases.

Dollar details: The intuitive, simple interface lets you see at a glance whether you’re overspending from any envelope. But don’t look for bells and whistles like text alerts or bank notices.

3. LEVEL MONEY, FREE

Great if:

You don’t care about categories—you just want to stop worrying about overdrawing your bank account

How it works: Level Money links to your bank and credit card accounts and considers any recurring bills and savings goals you enter. It then crunches the numbers to show you how much money is “spendable” for this day, week, and month.

Dollar details: You can drill down into specific categories to see how much you’re spending on transportation or healthcare or to compare this month’s dining out total to last month’s. But Level Money will appeal most to people who want to track their money just enough to know: Do I have the dough to afford this right now?

4. YOU NEED A BUDGET, $5/MONTH

Great if:

You want to scrutinize every cent

How it works: You Need a Budget (YNAB) combines the automatic and manual approaches of budgeting: It syncs with your bank accounts and credit cards, but it requires you to manually categorize and approve each expense. The result is a budget that can be more accurate and more top-of-mind, so the app actually influences your spending habits, but also requires more effort.

Dollar details: It’s easy to create a custom, comprehensive budget either on the app or through the website, and the app’s color-coded interface makes it easy to gauge at a glance whether you’re approaching your spending limits in a certain category. YNAB can also sync between devices to help keep you and your partner on track together.

5. HOMEBUDGET, $4.99-$5.99 (FREE FOR A LITE VERSION)

Great if:

Your income varies from month to month

How it works: Most budget apps devote a lot of space to tracking and monitoring what you spend. HomeBudget gives equal attention to tracking what you earn, which can be a boon to freelancers. On the expense side, you’ll manually enter expenses and categorize them. On the income side, you can enter and categorize clients.

Dollar details: HomeBudget shows each expense as a percentage of income, which can be a nice gut-check of whether that spendy meal out was actually worth it. But you can also dig into nitty-gritty reports to track budget categories over time. The app syncs between devices and has a search function that is surprisingly handy.